FAQ » ERC Program

What is the Employee Retention Tax Credit?

The ERC Program is one of the most powerful and paramount government aid programs to ever exist for US businesses. The employee retention credit is a stimulus program for business established by the CARES Act, and sponsored by the IRS.

The goal of this program is to reward businesses who retained their W2 Payroll employees during the Covid-19 pandemic (2020 and 2021) and continued paying their Payroll Taxes. Because this was a very difficult time for our nation, the US government is basically saying “Thank you” to business owners.

Businesses who retained their W2 Payroll employees during the Covid-19 pandemic can receive up to $26,000 per employee. ERC is a refundable tax credit – a grant, not a loan – that businesses can claim through an ERC filing process.

Who Qualifies for the Employee Retention Credit?

The ERC program was created for small-medium businesses that have faced economic hardship or have have had to make changes in the standard business operations due to Covid-19 government mandates. Employers who showed a decline in revenue, changes or adjustments in standard business operations, or partial / full business suspension during the Covid-19 pandemic and continued to pay employees on W2 payroll during the years of 2020 and 2021.

Qualified wages are wages paid, including health care costs, to the employee whether or not the employee is performing services. The credit can be claimed on all qualified wages. Companies looking to claim the ERTC must report their total qualified wages, as well as the related health insurance costs, on their quarterly tax returns (Form 941 for most employers).

An exciting opportunity to help businesses, and earn in the process.

This is an exciting opportunity that rewards you for introducing business who complete their ERC filing. Individual results will vary depending on market conditions, commitment levels and marketing skills of each Affiliate. Due to these conditions potential earnings estimates are not possible to provide.

There will certainly be Affiliates who will earn less while others will earn much more. We’re excited about the ERC referral partner program, and we believe it will provide you with a solid foundation to help businesses recoup funds via the ERC stimulus, and also create a way for you to earn in the process.

And overview of the ERC Referral Process

Referring a business to get their ERC is much easier than you’d think. There’s actually very little work involved for the affiliate other than simply introducing a business owner to the Employee Retention Credit. From there, the ERC system, processes, and automation will kick in and go to work.

Before you can begin onboarding new businesses, you must first complete the basic training course and quiz in order to activate / unlock you affiliate links. This is covered in the next FAQ. Then you can begin promoting ERC using the basic steps below.

Here are the main steps to onboard a new ERC Business:

- Introduce a business to the ERC program. (Ensure they have at least 5 W2 employees and have established their business prior to February 15, 2020)

- If they are interested use one of your ERC Marketing links to submit them into the system. You can share a link with them, or do it on their behalf.

- After submitting their information, you will be directed to the final step to book a call. Ensure a call is scheduled with an ERC Advisor on a date / time that works for the business owner.

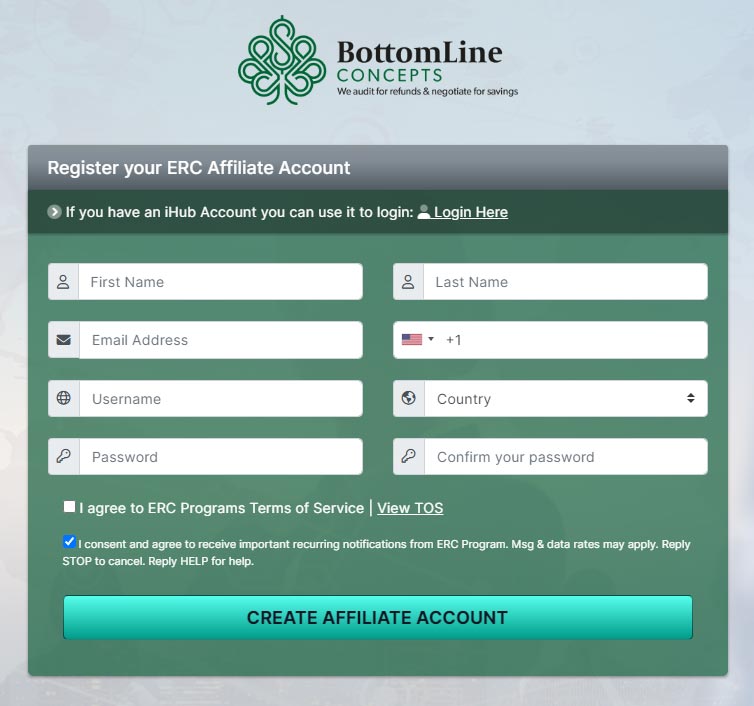

To become an ERC Referral Partner through this program, you must be invited by an existing referral partner. Once you are invited to join you will be able to create your free account.

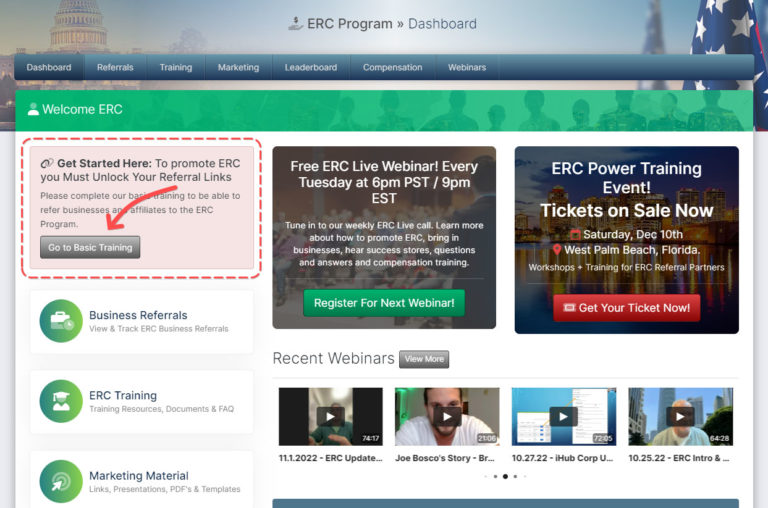

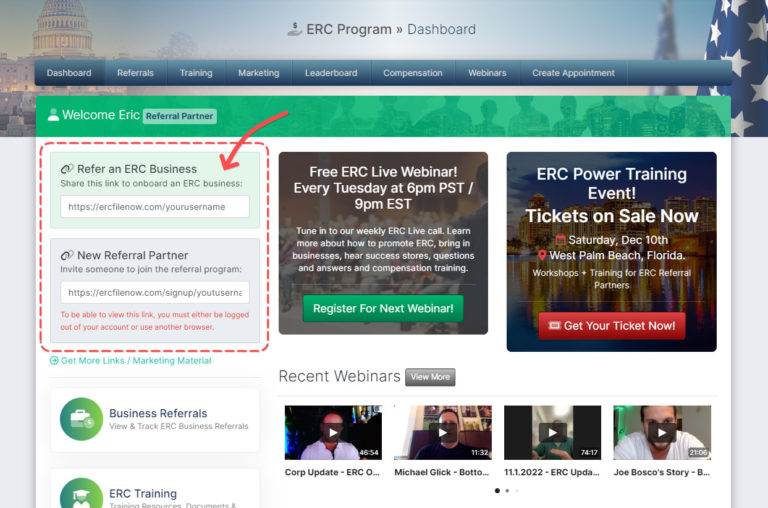

Activate your ERC Affiliate Links – Once you have access to your ERC Referral Partner account, the first step is to complete a short basic training course. You will see a call-out to to begin the the basic training as shown below:

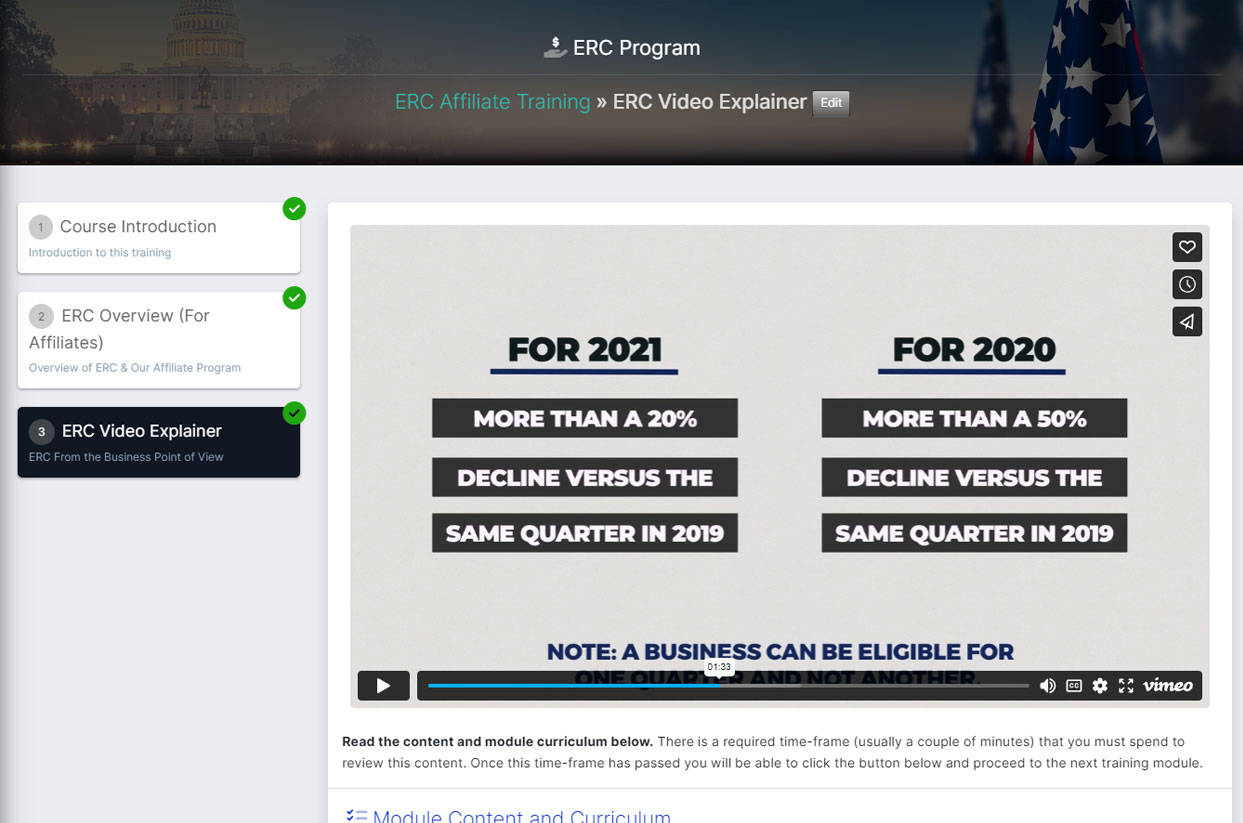

ERC Affiliate Program Course – Next you will go through a simple 3-4 module course should only take about 15 minutes to complete. It contains all the vital information that ERC Affiliates should know when promoting ERC to businesses and the primary qualifications that a business needs to have. It also is a great way to ensure that if you are building a team of referral partners that you don’t have to manually train each one, and answer all there questions – it streamlines the process for you.

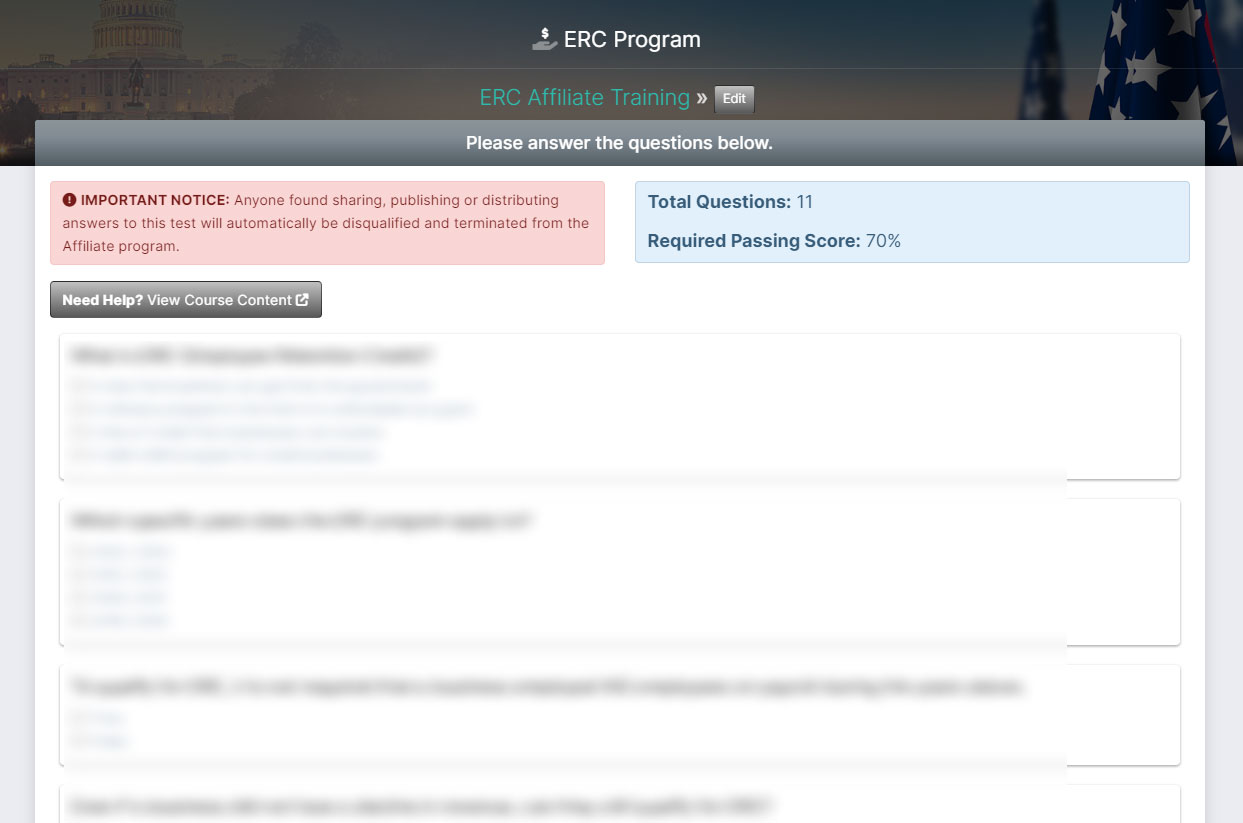

ERC Affiliate Quiz – At the end of the basic training modules there is a 10 question quiz used to ensure that the referral partner actually took the time to digest the information in the modules before. Once The quiz requires a 70% or greater passing score to proceed.

Once you pass, your referral links will now be unlocked and activated on your ERC Affiliate Dashboard. In other words you are ready to go out there are start introducing ERC to businesses and you will get credit for your referrals.

These are the basic pre-qualifiers for a business to be eligible for the ERC. However, don’t get caught up in these details, as the business owner will discuss all these matters with an expert ERC advisor. Our goal as ERC Affiliates is simply to get them scheduled for a quick 5 minute call – that’s it.

The only important things to ask them before getting them onboarded, is if the business was established on or before February 15th 2020 and if they have W2 employees – that is enough to onboard the business into the ERC system, and get them scheduled for further discussion with an ERC Advisor at Bottom Line Concteps.

- Was the business established on or before February 15th 2020?

- Did the business employ W2 employees in 2020 or 2021?

The business owner can answer yes to either #3 OR #4 below – it does not have to be both. - Did the business experience a decline in revenue during those years?

- Did the business experience a change in standard operations during those years? Some examples include:

- Change in business hours

- Partial or full suspension of your operations

- Shutdowns of your supply chain or vendors

- Reduction in services offered

- Reduction in workforce or employee workloads

- A disruption in your business (division or department closures)

- Inability to visit a client’s job site

- Suppliers were unable to make deliveries of critical goods or materials

- Additional spacing requirements for employees and customers due to social distancing

- Change in job roles/functions

- Tasks or work that couldn’t be done from home or while transitioning to remote work conditions

- Lack of Travel or Lack of Group Meetings

Important Facts about the ERC Stimulus Program

There are various factors than can affect the eligibility of ERC. Also, many businesses assume they do not qualify because of various assumptions. Here are some hard facts that will help:

- To qualify for ERC, businesses must have been established on or before February 15th 2020

- To qualify for ERC, businesses must have had W2 employees on payroll during eligible quarters during the years of 2020 and 2021

- Independent contractors (1099) and the compensation paid to these individuals are not eligible for ERC

- Even if companies received PPP, they still can qualify for ERC.

- Even if your business did not have a revenue reduction or was deemed essential, they still qualify for ERC

- ERC is a refund in the form of a grant and can return up to $26,000/employee ($10,000 is the average for companies that received PPP, $20,000 is the average for businesses that didn’t)

- Simple operational impacts can qualify a business for ERC as well such as change in: job roles, business hours, reduction in services or workforce

- This stimulus program was established by the CARES Act, it is a refundable tax credit – a grant, not a loan – that your business can claim. The program is based on qualified wages and healthcare paid to employees.

- Businesses have until April 2024 to claim ERC retroactively for 2020, and until April 2025 to claim ERC retroactively for 2021. They have the ability to do a look back on their payroll during the pandemic and retroactively claim the credit by filing an amended tax return.

- For tax year 2021, the refundable tax credit is: 70% of qualified wages paid per employee (up to a maximum amount of $7000 per employee, per quarter and up to $21,000 for the entire year)

- For tax year 2020, the refundable tax credit is: 50% of qualified wages paid per employee (up to a maximum amount of $5000 per employee for the entire year)

- Typical turn around times for funds to be collected from the ERC program is 4-6 months for smaller sized businesses, and up to 12 months for larger size businesses.

- To date, 84% of businesses have not filed for ERC, and most do not even know this program exists.

Before introducing ERC to a business, remember what you’ve learned from the basic training, and some of pre-qualifiers from the previous FAQ above. If a business did not have W2 employees at all during 2020 and 2021, they won’t qualify for ERC. So be mindful as to not waste their time, or yours.

The best strategy to open a conversation to a business owner is by asking them this simple question: “Have you heard of, or filed for the Employee Retention Credit”?

There are 4 possible answers you will receive:

- Business Owner: “Yes, I’ve already filed for the ERC.”

- Your response: “Wow, that’s great to hear! Well done! It’s awesome to see that savvy business owners like you are staying up to date, and taking advantage of the ERC program.

- Your response: “Wow, that’s great to hear! Well done! It’s awesome to see that savvy business owners like you are staying up to date, and taking advantage of the ERC program.

- Business Owner: “Yes, I’ve heard of it, but haven’t filed for ERC”

- This is an excellent response because you know they are familiar with the ERC program.

- Your response: “Oh good, I’m glad you’ve heard of it! So you are aware that the Employee Retention Credit is a Government stimulus program that will pay up to $26,000 per W2 employee in the form of a grant – not a loan.”

(Let them answer)

“I’d love to put you in touch with an excellent company that will handle the whole process for you with no upfront cost. They’ve done this for over 16,000 businesses and recovered over $3 billion dollars. They actually specialize in ERC.

“Can I schedule you for a quick 5 minute call with one of their expert ERC advisors? They will pre-qualify you on the phone, answer any questions you may have, and get started on your ERC filing?”

(Let them answer)

“Great what day and time works best for you?”

Collect Info: Day, Time, Name, Email, Phone, Business Name, Business Category, Amount of W2 employees. (See how to onboard a new ERC Client in the next FAQ)

- This is an excellent response because you know they are familiar with the ERC program.

- Business Owner: “No, what is ERC?”

- In this case you want to do some quick education on ERC first, then follow similar approach from your response step 2.

- Your response: “Well, we’re about to have a very exciting conversation!

The ERC (Employee Retention Credit) is a stimulus government aid program established by the CARES Act. It is a refundable tax credit – a grant, not a loan – that businesses can claim and receive up to $26,000 per employee. This is a check that comes directly from the IRS.

The ERC program was specifically created to help companies who retained their W2 employees during the Covid-19 Pandemic. The US Goverment is essentially rewarding businesses who did so, because this was one of the most difficult times in our history.”

(Let them answer)

“I’d love to put you in touch with an excellent company that will handle the whole process for you with no upfront cost. They’ve done this for over 16,000 businesses and recovered over $3 billion dollars. They actually specialize in ERC.

“Can I schedule you for a quick 5 minute call with one of their expert ERC advisors? They will pre-qualify you on the phone, answer any questions you may have, and get started on your ERC filing”

(Let Them Answer)

“Great what day and time works best for you?”

Collect Info: Day, Time, Name, Email, Phone, Business Name, Business Category, Amount of W2 employees. (See how to onboard a new ERC Client in the next FAQ)

- In this case you want to do some quick education on ERC first, then follow similar approach from your response step 2.

- Business Owner: “We don’t qualify.”

- Believe it or not, This is probably the best answer you can. Statistically we have found that 80% of businesses that have been told they don’t qualify actually do in one way or another. Commonly business owners are told they don’t qualify by their advisor or CPA. This can be due a variety of reasons such as: They are not up to date on the stimulus and the fact that new ways to qualify have been introduced, or they do not have the expertise to prepare the filing. We've even heard answers of “We are too busy”. Regardless of the reason, this is your time to shine.

- Your response: “Really? We hear that all the time, and 80% of the businesses that have told us they don’t qualify – we get them their ERC.

(Let Them Answer)

“I’d love to put you in touch with an excellent company that will handle the whole process for you with no upfront cost. They’ve done this for over 16,000 businesses and recovered over $3 billion dollars. They actually specialize in ERC.

“Can I schedule you for a quick 5 minute call with one of their expert ERC advisors? They will pre-qualify you on the phone, answer any questions you may have, and get started on your ERC filing”

(Let Them Answer)

“Great what day and time works best for you?”

Collect Info: Day, Time, Name, Email, Phone, Business Name, Business Category, Amount of W2 employees. (See how to onboard a new ERC Client in the next FAQ)

- Believe it or not, This is probably the best answer you can. Statistically we have found that 80% of businesses that have been told they don’t qualify actually do in one way or another. Commonly business owners are told they don’t qualify by their advisor or CPA. This can be due a variety of reasons such as: They are not up to date on the stimulus and the fact that new ways to qualify have been introduced, or they do not have the expertise to prepare the filing. We've even heard answers of “We are too busy”. Regardless of the reason, this is your time to shine.

Below, we will provide a list of common questions, objections, and rebuttals from business owners. Some of these are more tricky than others, but rest assured you will now be armed with the correct responses to each of these questions.

Can I file ERC with My Accountant or CPA?

Many businesses will ask “Why don’t I just file ERC with my CPA?” The answer is because of the complexity and expertise required to properly file for Employee Retention Tax Credit. It's important that a business understand that there is tremendous valus choosing a company that specializes in ERC, and has a proven track record of recovering funds for many businesses. Because a CPA may have filed PPP for a business does not mean they will be able to file your ERC. They are very different types of filing, paperwork, and calculations. PPP is a loan, meanwhile ERC is a grant.

The ERC is a complex 300 page stimulus plan that has been amended, revised, and changed over time. This requires a CPA to know every facet of how the ERC stimulus program has been updated. They also must posses the expertise to properly file for ERC and maximize the credit.

It’s simply a fact that many standard CPA’s and accountants do not have the experience or know-how in understanding how the program works, whether a business is eligible or what qualifies a business, and how to file for ERC. Let's break down a discussion scenerio below:

- Question: Why don’t I just have my CPA handle this for me? (I feel comfortable with accountant)

- This is probably one of the most important questions to be able to answer. And as frustrating as it may be it is important to be armed with the correct response.

- Response Option 1: “Great question, and totally makes sense for you to ask or suggest that – we hear it often. Respectfully, you are more than welcome to consult with your CPA - I am just surprised that they haven't already told you about the ERC program since it's been around for over a year and half. Do you think it would be worth 5 minutes of your time to speak with an expert ERC advisor at Bottom Lines Concepts? They are an outstanding ERC firm that has filed ERC for over 16,000 businesses and recovered over $3 billion in funds, what do you have to lose?"

- Response Option 2 (Aggressive): “Great question, and totally makes sense for you to ask or suggest that – we hear it often. Respectfully, I would just l like to make sure I understand your train of thought correctly:

So, you want to go back to the person:

– Who did NOT tell you about the ERC program, although it’s been around for a year and half.

– Who doesn’t specialize in this type of very complex filing?

– Who will most likely charge you upfront for their time in understanding the 300 page ERC stimulus bill, and preparing the filing.

– And who may not be able to maximize your ERC Tax Refund?

What I’m asking is for you to not make any decisions right now, and simply 5 minutes of your time to have a quick call with an expert ERC advisor from Bottom Line and see what your options are. Worst case you will get off the phone, and be even more educated, and have a better sense of direction on how to go about getting your Employee Retention Credit.

- This is probably one of the most important questions to be able to answer. And as frustrating as it may be it is important to be armed with the correct response.

- What time period does the ERC program cover?

- The program began on March 13th, 2020 and ends on September 30, 2021, for eligible employers. The statute of limitations to apply for the 2020 ERC does not close until April 15, 2024. The statute of limitations to apply for the 2021 ERCs does not close until April 15, 2025.

- The program began on March 13th, 2020 and ends on September 30, 2021, for eligible employers. The statute of limitations to apply for the 2020 ERC does not close until April 15, 2024. The statute of limitations to apply for the 2021 ERCs does not close until April 15, 2025.

- If I already received PPP can I still get ERC?

- Yes. Under the Consolidated Appropriations Act, businesses can now qualify for the ERC even if they already received a PPP loan. Note, though, that the ERC will only apply to wages not used for the PPP.

- Yes. Under the Consolidated Appropriations Act, businesses can now qualify for the ERC even if they already received a PPP loan. Note, though, that the ERC will only apply to wages not used for the PPP.

- Does my business qualify even if there wasn’t a decline in revenue?

- Yes, If you had a change in your standard business operations during the pandemic, or your business was impacted by the Covid-19 goverment mandates. Some example include change in: job roles, business hours, reduction in services or workforce

- Yes, If you had a change in your standard business operations during the pandemic, or your business was impacted by the Covid-19 goverment mandates. Some example include change in: job roles, business hours, reduction in services or workforce

- Do I need to pay back ERC?

- No. ERC is a refundable tax credit – a grant, not a loan – that businesses can claim.

- No. ERC is a refundable tax credit – a grant, not a loan – that businesses can claim.

- How much money can I get?

- ERC is a refund in the form of a grant and can return up to $26,000/employee ($10,000 is the average for companies that received PPP, $20,000 is the average for businesses that didn’t)

- ERC is a refund in the form of a grant and can return up to $26,000/employee ($10,000 is the average for companies that received PPP, $20,000 is the average for businesses that didn’t)

- How long does it take to receive the funds after the ERC filing is submitted?

- Smaller size businesses can see funds in anywhere to 4-6 months, while larger businesses may experience turn around times up to 12 months.

One of the best strategies is to use your warm market list. These are people you know, places you frequent, and business owners that would be open minded if you were to pick up the phone and give them a call. In other words, leverage your existing relationships. This is the best place to start.

Sit down and make a list of everyone you know. Use the strategies above in “How to Introduce the ERC Program to a Business Owner”

Here’s some examples:

- Your Dentist

- Your Doctor

- Where you get your car serviced / repaired

- Your local grocery store

- Your children’s school.

- Your local church

- Your local restaurants that you frequent

- Your friends

- Your family

- Business associates

- etc..

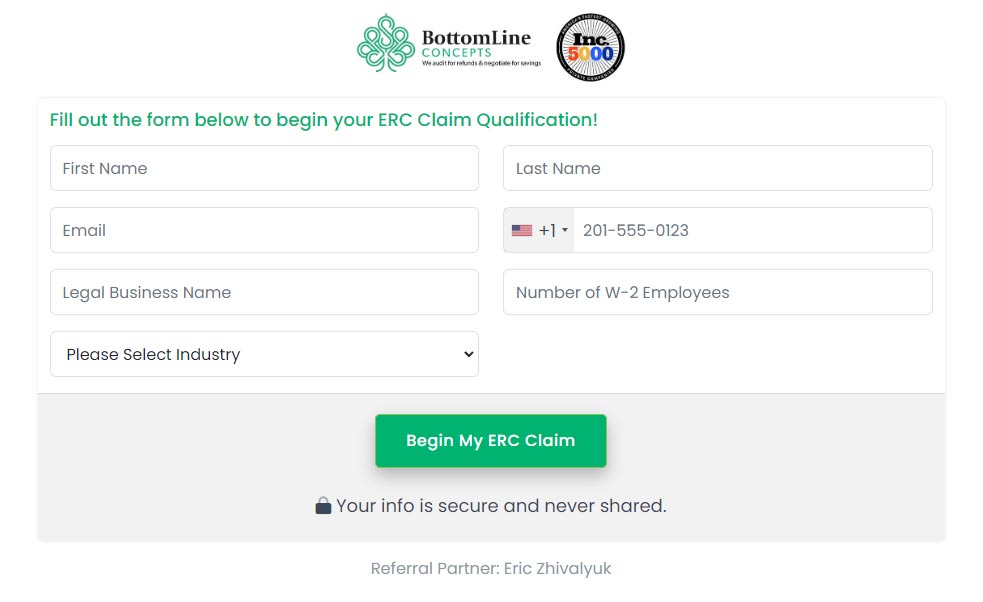

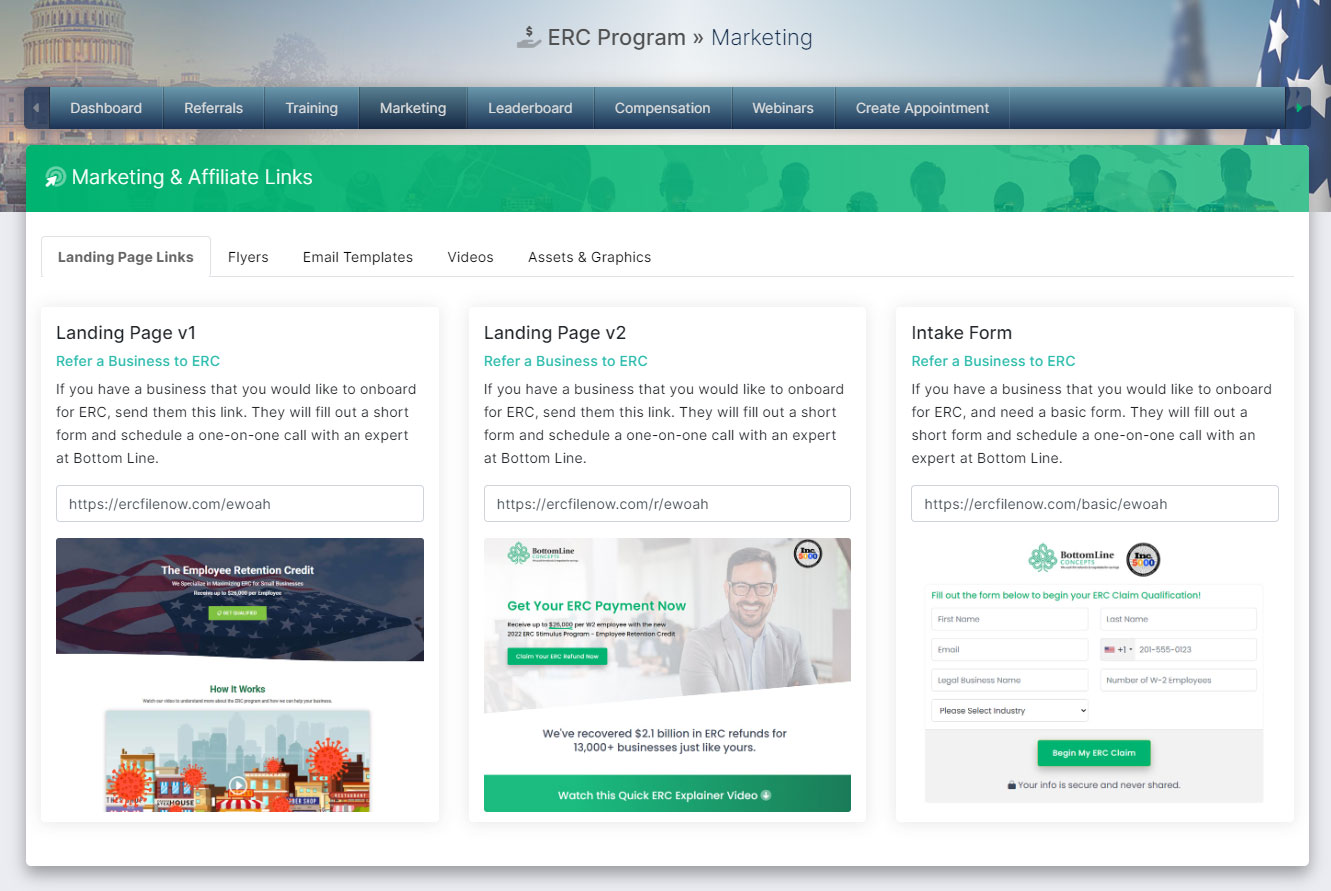

To onboard a new client using this ERC affiliate program, you must use the links or forms provided in your ERC Affiliate Backoffice. Under the marketing tab, you will find various links that you can use in the two following ways.

ERC Affiliate Landing Page

You can use ERC affiliate landing page links to send over to a potential prospect. The goal of these pages is to educate, build trust, and allow the business owner to self onboard themselves. Everything is tracked back to your affiliate account, where you have full visibility in your ERC Affiliate Backoffice.

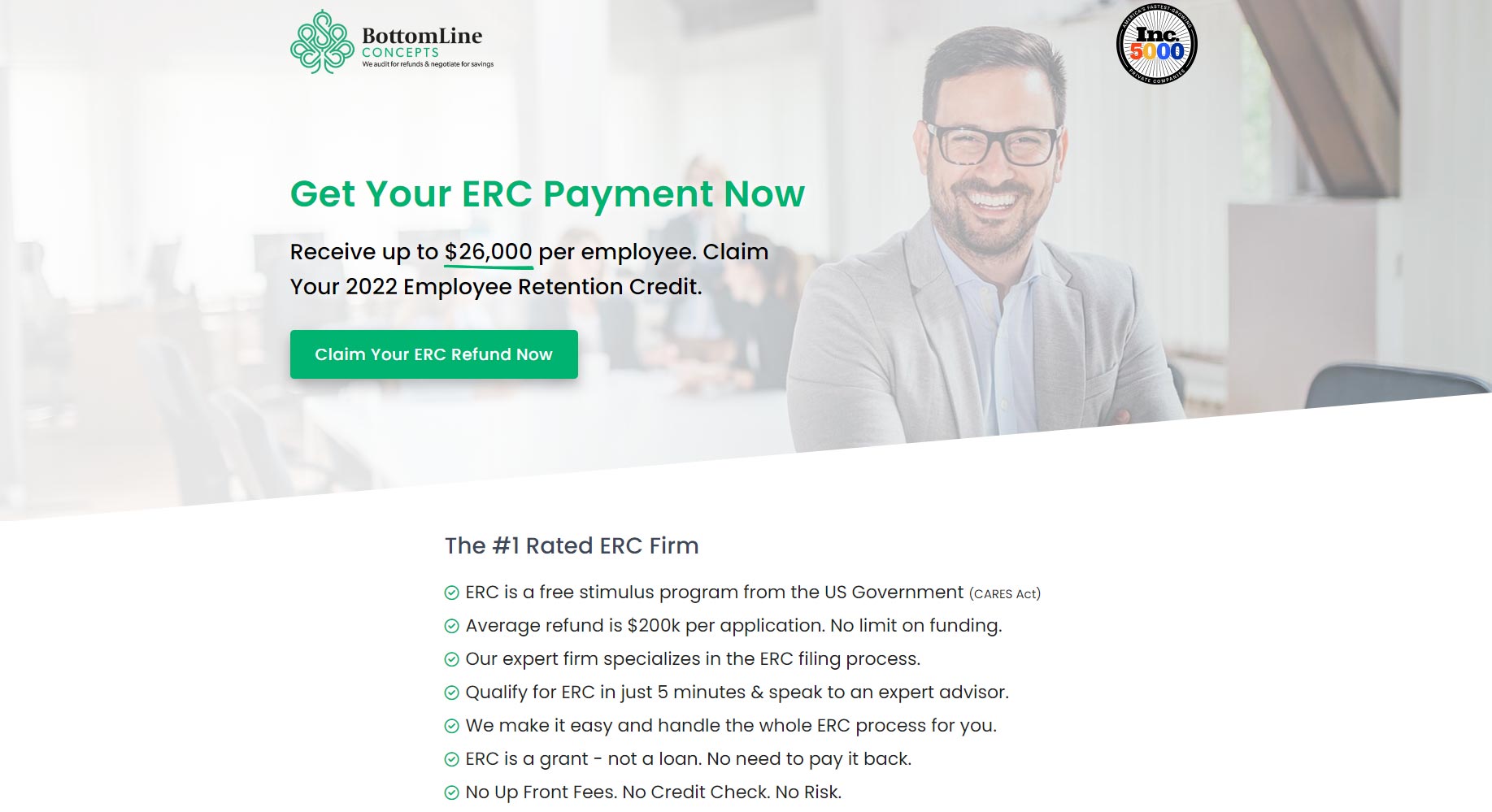

When coming to this page, the business owner will fill out a very short form. After filling out the form, they will be directed to another page to schedule a quick call with an expert ERC advisor at bottom line concepts. There are over 35 ERC advisors that are on round-robin rotation taking calls, with plenty of availability and scalability. They are friendly, experienced, and very personable. We have heard incredible feedback from customers.

ERC Intake Form

If you already have spoken with a business owner on the phone perhaps, and they are ready to proceed, there is no reason to send them a link to a landing page. You can use a simple form to onboard them, and schedule the call with the ERC advisor on their behalf. Essentially this is the same exact process as above, but you are doing it for them with their permission.

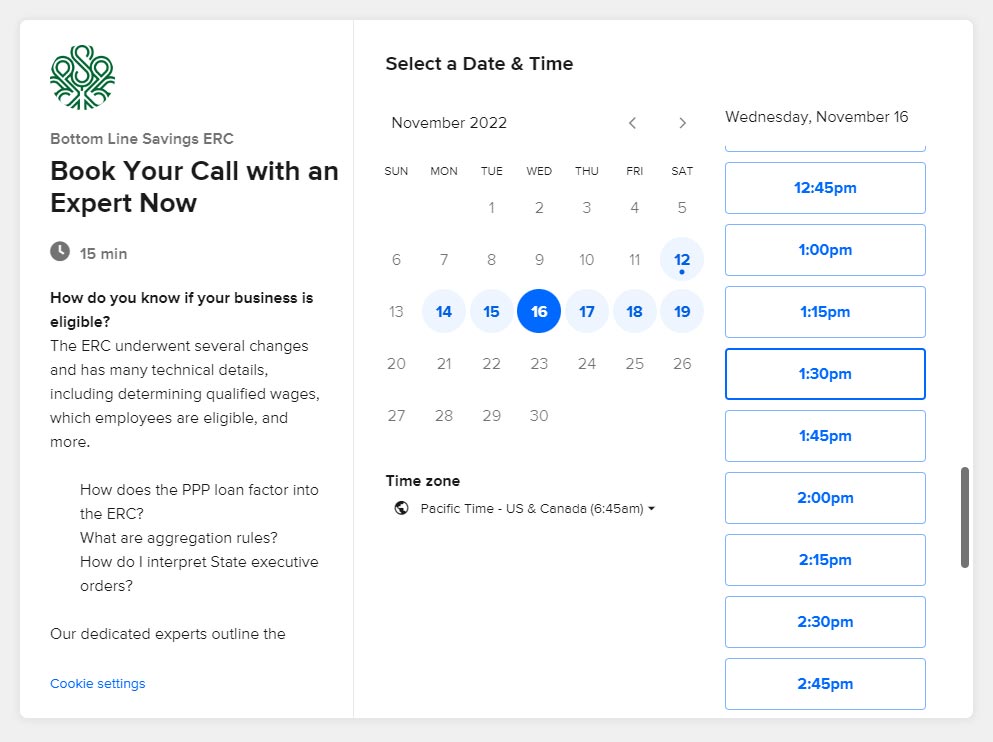

Scheduling the Call with an ERC Advisor

Regardless of which method above is used, they will both lead to schedule a call. Not much to explain, but wanted to ensure we can see the full process. The form will pass the data into Calendly scheduling page, where you or the business owner (depending on which method is used) can book the call at the time that is best for them.

IMPORTANT! Everything discussed here is the referral program specifically put together by iHub Global via their exclusive partnership with Bottom Line Concepts. Which means you must signup under a referral partner that is using the iHub Global system.

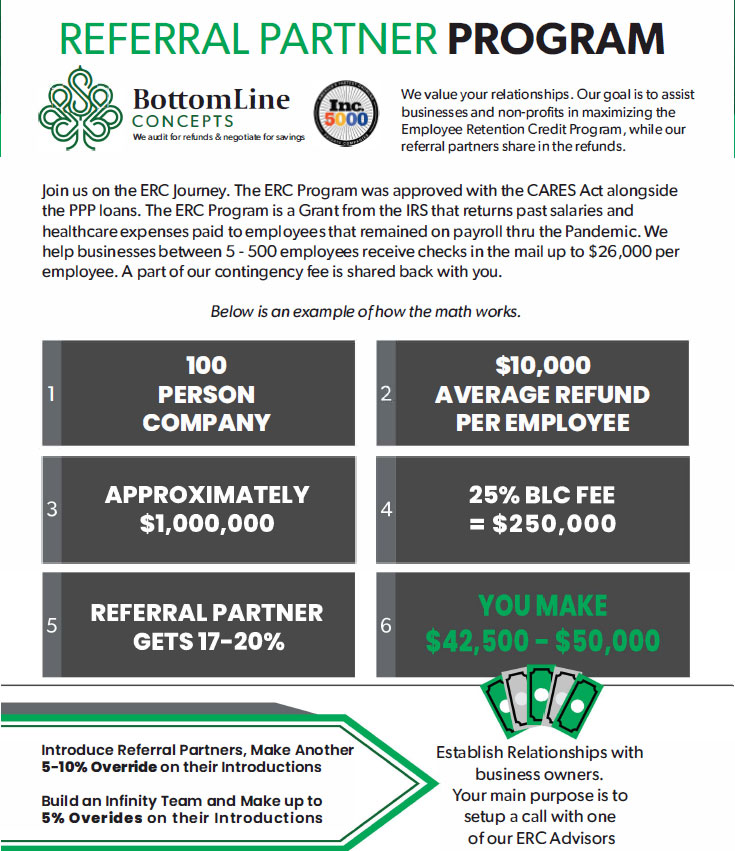

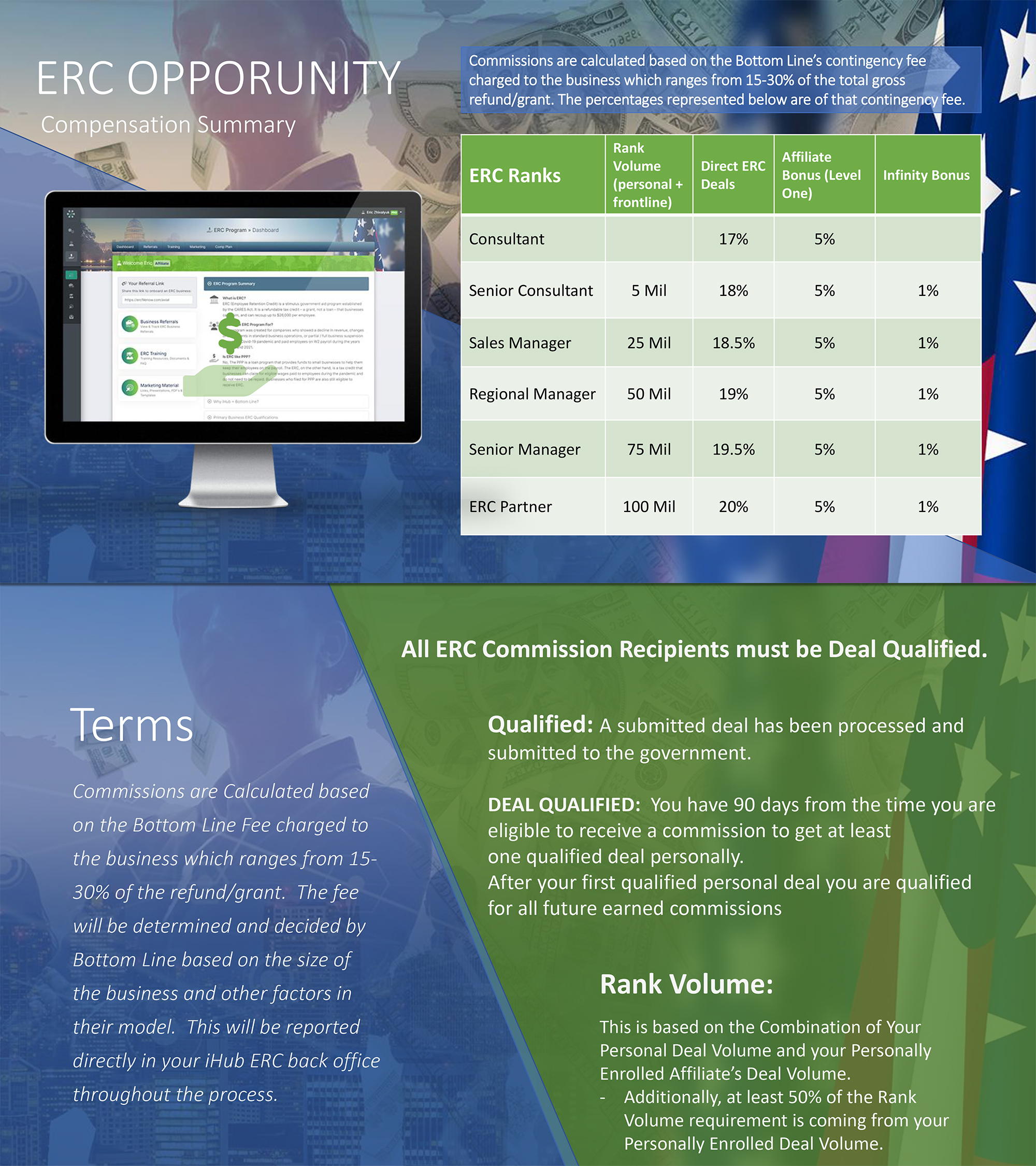

This ERC Affiliate program offers a superior compensation plan to all those we’ve seen out there. All earnings for referral partners are derived from a portion contingency fee that Bottom Line Concepts charges the client only after they’ve received their funds from the IRS. Also importantly noted that each client engages into a legal binding retention agreement with Bottom Line Concepts – prior to them preparing the ERC Filing.

Needless to say, looking at the example below – the earning potential of this ERC affiliate program is massive! Even just one deal could deliver significant income!

You have the ability to earn in 3 ways, and increase your earnings along the way.

- Directly referring a business to the ERC program.

- Bringing in referral partners and earning from their directly referred ERC Businesses.

- A leveraged infinity bonus infinite levels deep in your downline also known as genealogy.

Income Disclosure Statement: This is an exciting opportunity that rewards you for introducing business who complete their ERC filing. Individual results will vary depending on market conditions, commitment levels and marketing skills of each Affiliate. Due to these conditions potential earnings estimates are not possible to provide.

There will certainly be Affiliates who will earn less while others will earn much more. We’re excited about the ERC referral partner program, and we believe it will provide you with a solid foundation to help businesses recoup funds via the ERC stimulus, and also create a way for you to earn in the process.

For full details on the ERC compensation plan please visit: ERC Affiliate Backoffice > Compensation

ERC Compensation Plan Summary

- ERC Affiliate Backoffice

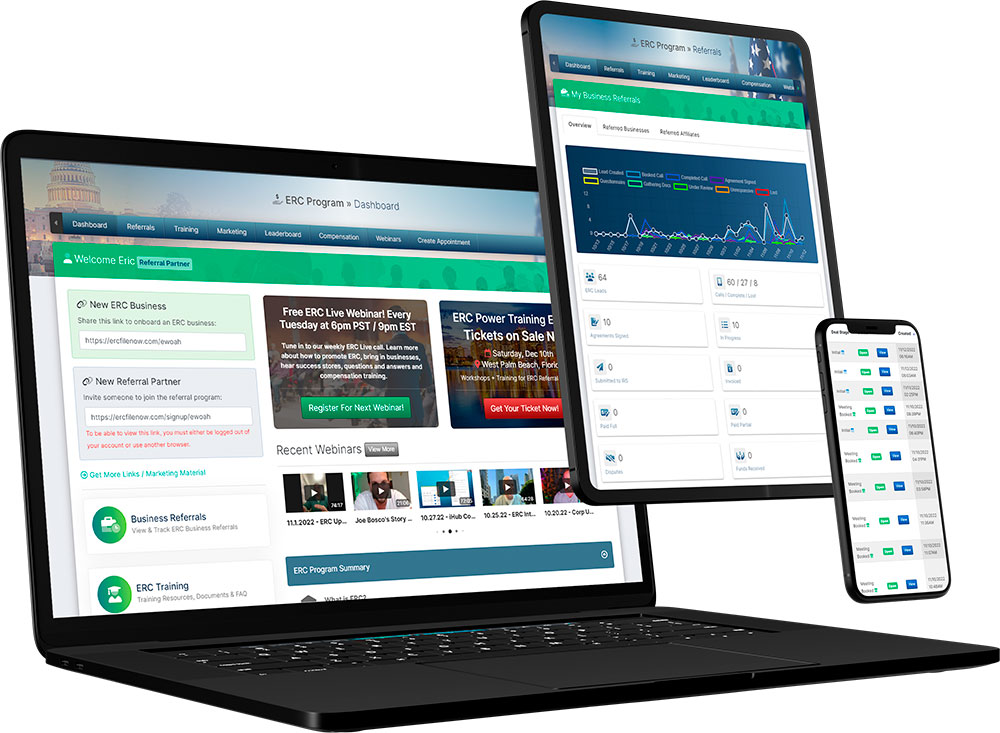

The technology and resources powering this affiliate program has no limits. Every ERC Referral Partner has access to a powerful Backoffice platform that delivers everything you could possibly need and want when promoting this opportunity. We will breakdown each section, and what is available to you as a referral partner, so you can hit the ground running.

-

ERC Affiliate Dashboard

The ERC Affiliate dashboard provides quick access to the most important tools and resources. On there you will find your ERC referral links, webinars, events, ERC program quick training, and call-outs to the more vital sections of the backoffice.

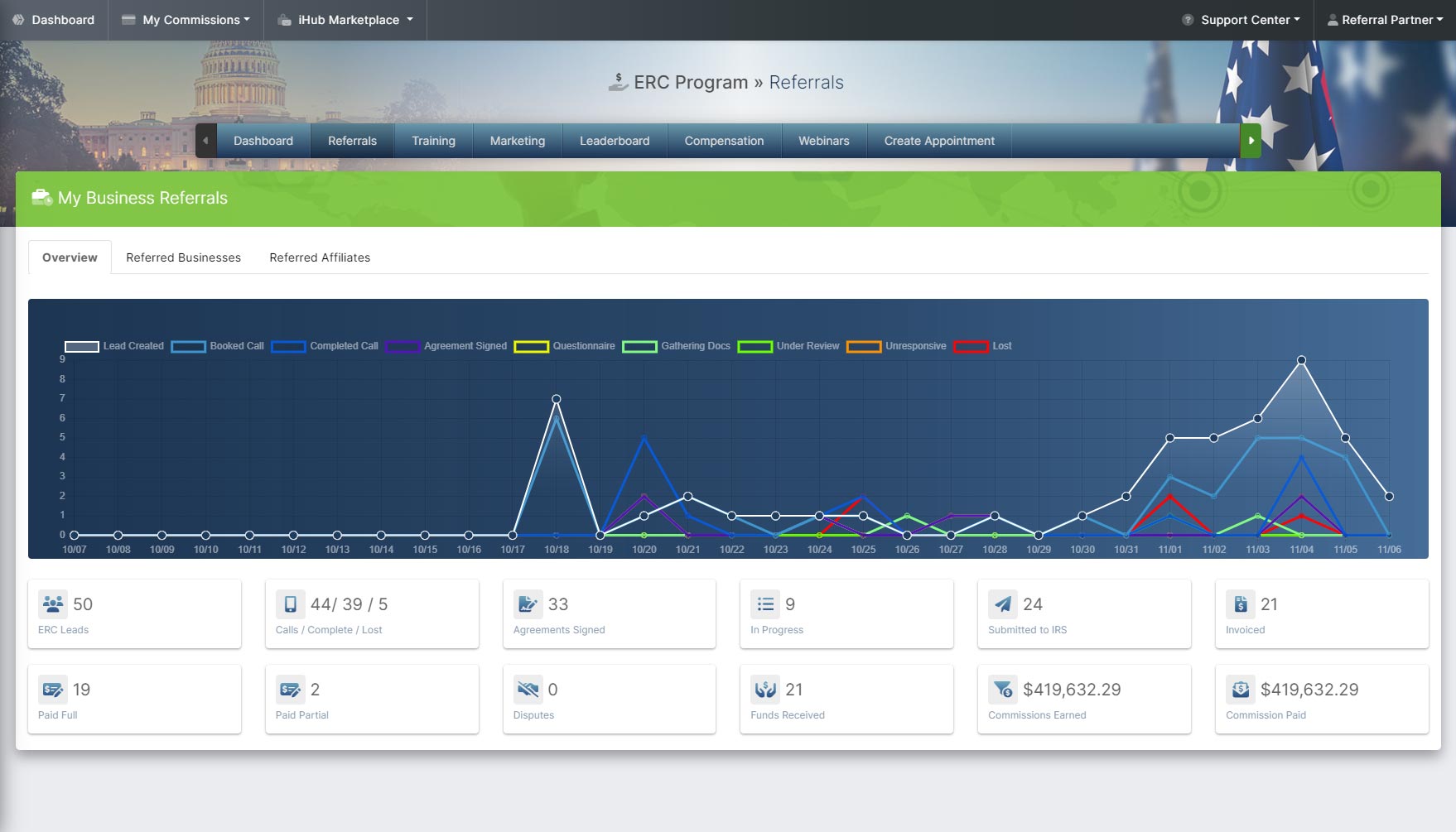

ERC Referral Tracking Summary

The most important resource that this ERC Referral Program delivers is complete tracking, visibility and transparency. When referring businesses to the employee retention credit, you are going to want to know exactly what’s going on with each one of your referrals.

Luckily, we have this provided for every ERC Referral Partner in your Referrals. A full overview of all your deals in totality with charts and widgets, as well as a detailed breakdown list of each business, and their current status. The system is updated every hour on the hour with data directly Bottom Line Concepts. As the business moves through the ERC process starting with their scheduled call, collecting documents, preparing their filing, submitting to the IRS, and receiving payment – all of this is available to keep you up to date, every step of the way.

ERC Referral Overview Section

The business referral overview section provides your entire ERC referral business from a glance. You can see the chart outlines the most important statuses as the clients move through different deal stages (outlined below).

Lower on the page you will see a pipe-line of widgets that show those numbers with more granularity so you can easily see what’s going on from a birds-eye view.

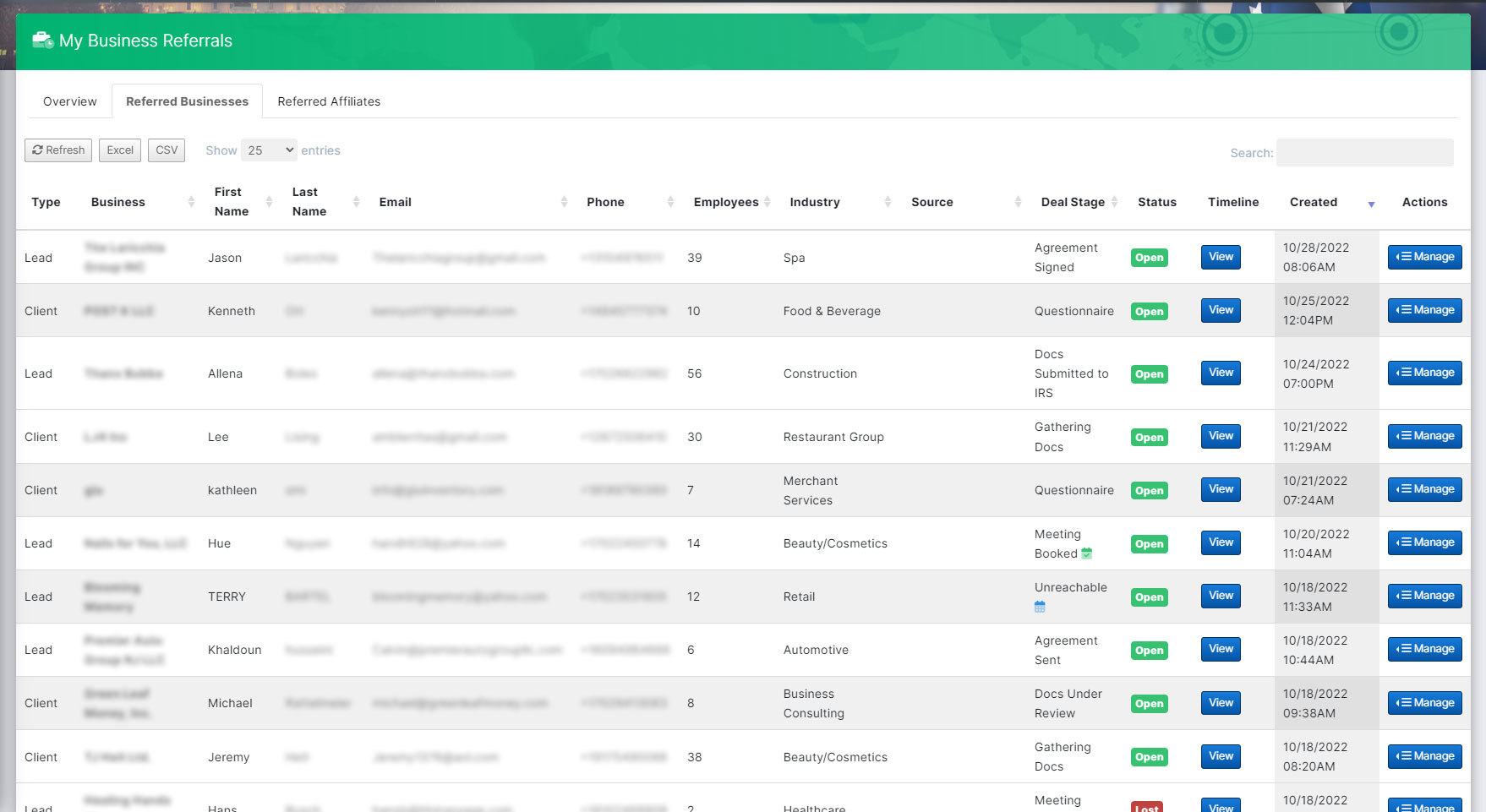

Referred ERC Businesses List Section

Detailed List – Under the “Referred Businesses” tab you can see a detailed, searchable, sortable table list of your deals. As mentioned previously the “Deal Stages” are updated in the system every hour. As soon as there is some progress with one of your referred businesses, you’ll know pretty quickly.

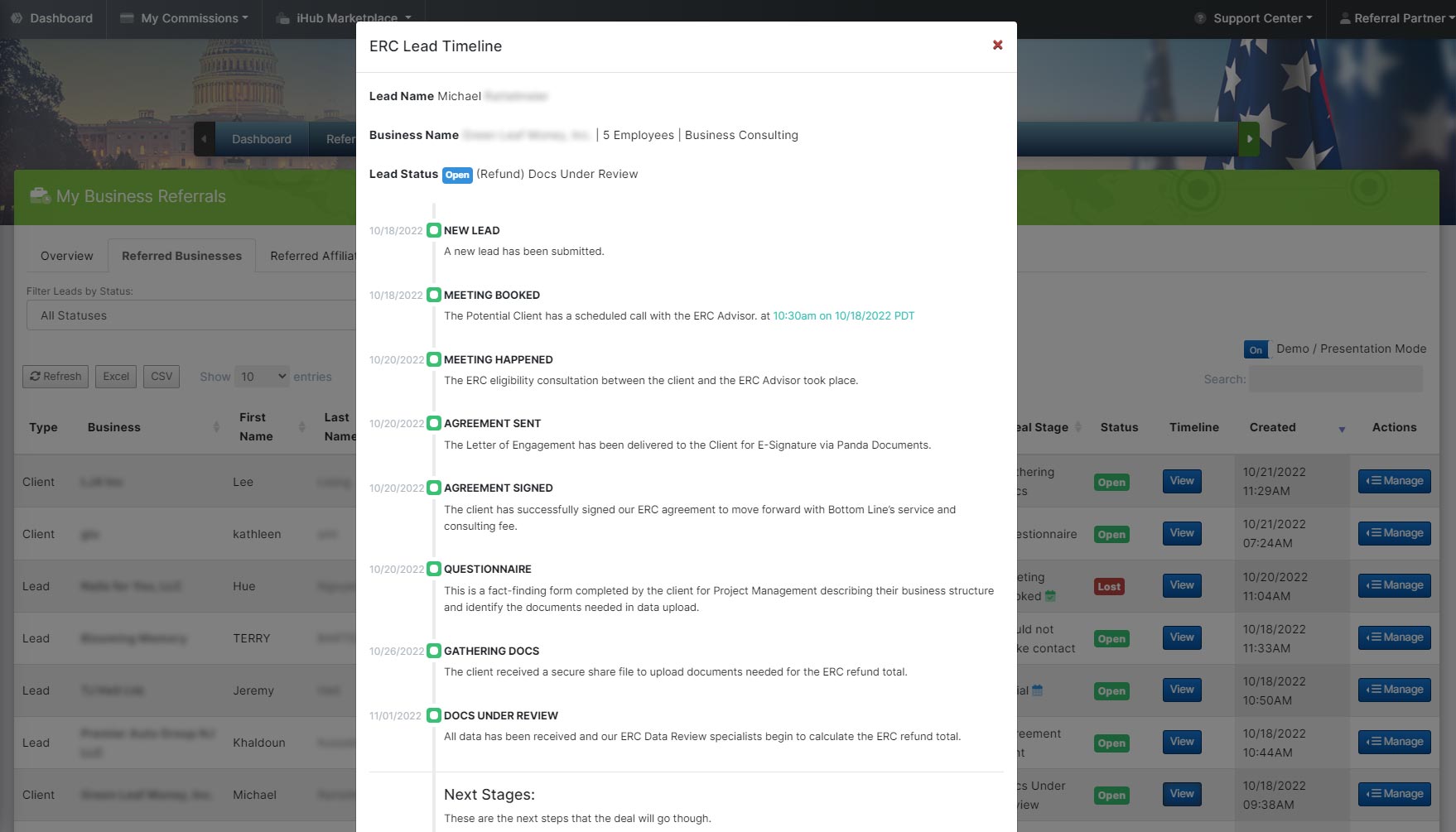

Timeline View – You can also view each deal individually and get a historical timeline of updates and events that have occurred. This way you get a clear picture of each business and how they are moving through the ERC filing process. In the next FAQ you can see an overview of each deal stage/status and what they mean.

Below is a list of all of the possible statuses that can occur for each ERC deal. They are broken down into 2 categories.

ERC Deal Stages

- New Lead (Initial) – A new lead has been submitted

- Meeting Booked – The Potential Client has a scheduled call with the ERC Advisor

- Unreachable – The ERC Advisor has attempted to call the client via phone and email but was unsuccessful.

- Meeting Happened – The ERC eligibility consultation between the client and the ERC Advisor took place

- Lead Unresponsive – The client has not responded the ERC Advisor or the Project Management team since our contract was sent out.

- Agreement Sent – The Letter of Engagement has been delivered to the Client for E-Signature via Panda Documents

- Agreement Signed – The client has successfully signed our ERC agreement to move forward with Bottom Line’s service and consulting fee

- Lead Unresponsive (Signed) – The client has signed the ERC contract but has not moved forward and is non-responsive.

- Questionnaire – This is a fact-finding form completed by the client for Project Management describing their business structure and identify the documents needed in data upload

- Gathering Docs – The client received a secure share file to upload documents needed for the ERC refund total

- Docs Under Review – All data has been received and our ERC Data Review specialists begin to calculate the ERC refund total

- Docs to be Submitted to IRS – Total refund amount it calculated and presented to the client and 941 Preparation Begins

- Docs Submitted to IRS – Bottom Line receives confirmation from the client to submit 941x Forms to the IRS on their behalf

ERC Collection Stages

- ERC Submitted (1-30 Days ago) – Deal was submitted successfully to the IRS 1-30 days ago

- ERC Submitted (31-60 Days ago) – Deal was submitted successfully to the IRS 31-60 days ago

- ERC Submitted (61-90 Days ago) – Deal was submitted successfully to the IRS 16-90 days ago

- ERC Submitted (91-120 Days ago) – Deal was submitted successfully to the IRS 91-120 days ago

- ERC Submitted (121-150 Days ago) – Deal was submitted successfully to the IRS 121-150 days ago

- No IRS Communications Received – Deal was submitted successfully to the IRS over 150 days ago and no communication from the IRS was received yet.

- Client Unresponsive – Deal was submitted successfully to the IRS over 150 days ago and client did not respond to at minimum 5 attempts to contact them. 2 emails + 3 phone calls

- Client Received IRS Communications – Client received Communications from the IRS and we are attempting to get them in order to invoice

- Client Invoiced – Notice – Client received notices from the IRS and was invoiced, awaiting checks before full collection efforts

- Client Invoiced – Checks – Client was invoiced and we confirmed they received checks from the IRS. Awaiting payment

- Client Paid Partial – Client received checks for some of the quarters that were filed for and paid us for those quarters, awaiting remaining check(s) from the IRS.

- Payment without Noticed – Client sent us payment without sharing notices or checks. Likely underpaid due to interest.

- Client in Dispute – Client is disputing our bill and refusing full payment.

- Client Paid in Full – Client received all checks and paid us in full

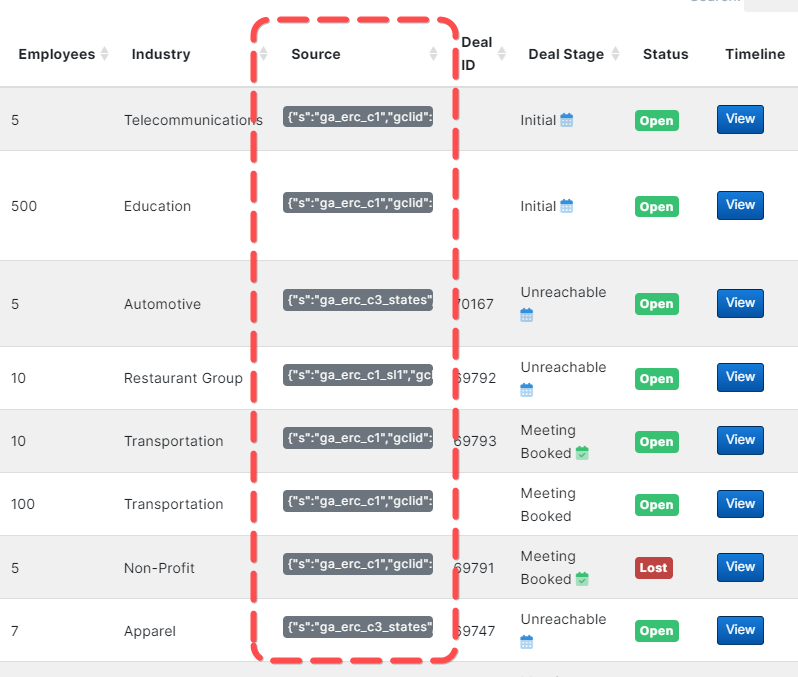

You can custom tag any referral URL, which will help you identify the source of each lead the comes into the system. This is especially helpful if you are sharing, posting, and marketing your links online, and want to ensure that you can discerne which marketing efforts are working best.

Here are some usage examples of how to add tracking tags on your referral and landing page URLs. There is no limits on how many tags you can apply to one URL, or what the naming scheme of the tags. As long as they are formatted correct they will be pulled back into the lead record, where you can reference the tags in the "Source" column of your business referrals table list.

Single Tracking Tag Examples

https://ercfilenow.com/username?email=campaign1

https://ercfilenow.com/username?email=myfriends

https://ercfilenow.com/username?ad=googlead1

https://ercfilenow.com/username?ad=facebookad1

https://ercfilenow.com/username?custom=whatever

Using multiple tracking sources (Unlimited Tracking Variables)

https://ercfilenow.com/username?email=myfriends&followup=3

https://ercfilenow.com/username?ad=googlead1&graphic=restaurantowner

https://ercfilenow.com/username?source1=target1&source2=target2&source3=target3&source4=target4

Referencing your tags in your leads:

In your Referrals > Referred Business Tab, reference the "Source" column.

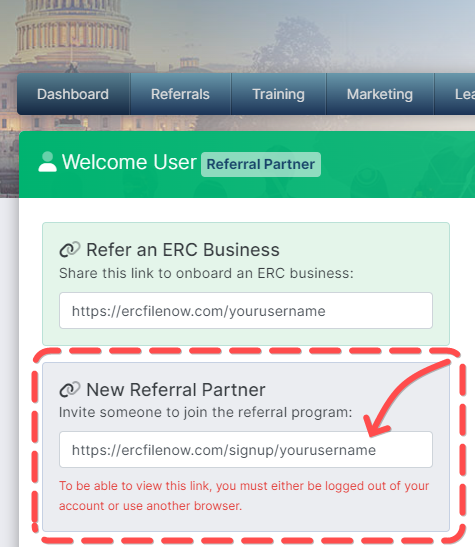

The ERC Referral program allows you to invite and onboard a new referral partner. Based on the compensation plan, you have the potential to earn a percentage from each ERC business they onboard into the system.

How to onboard a new Referral Partner

- Go to your ERC Dashboard and copy the link found in the "New Referral Partner" box.

- Share this link via text message or email with the person that you want to invite.

- They will be able to create their referral partner account.

Please note:

- If you did not complete the basic training yet, you will not have access to onboard new businesses or referral partners.

- If you try to access this link while you are currently logged into to the system, it will re-direct you to your dashboard. You can either logout, use another browser, or open an incognito window to be able to view this link.

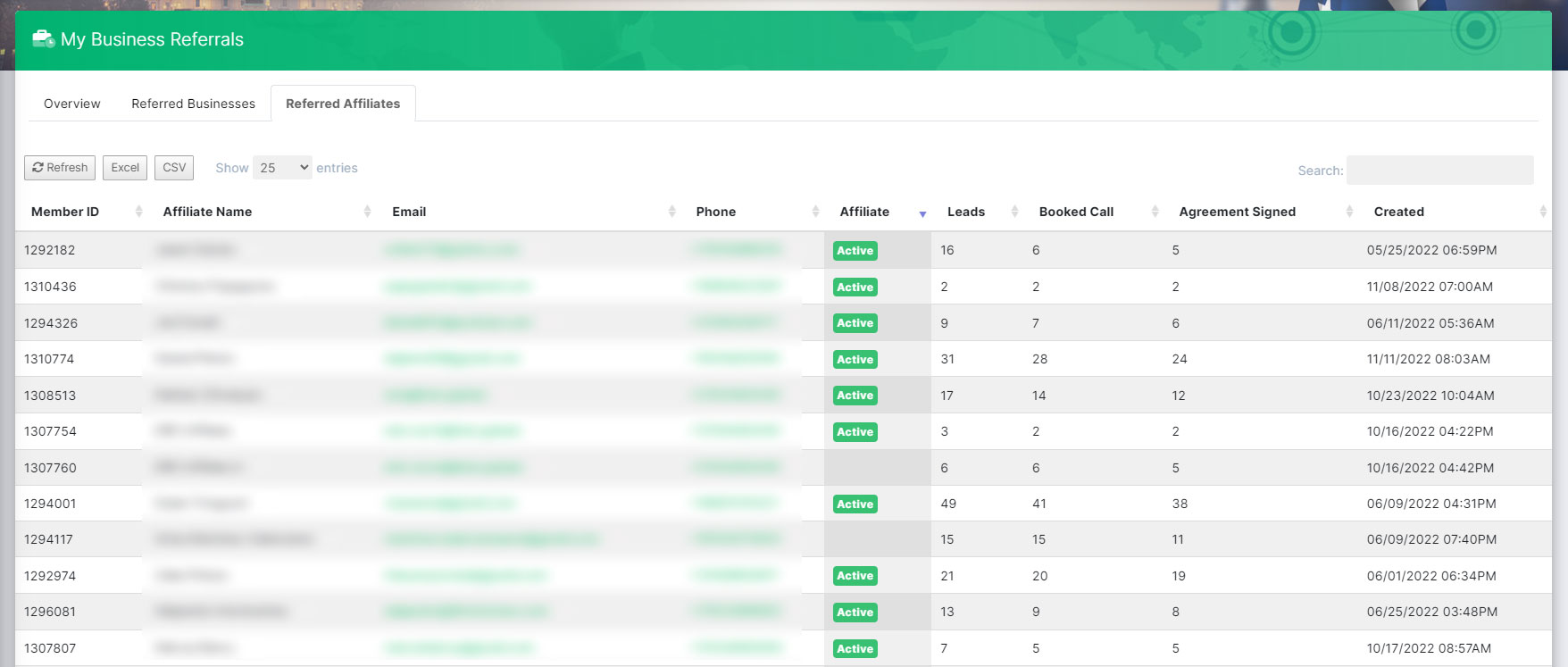

How to view your Referral Partners and their ERC activity

You can view a list of all your direct referrals by going to Referrals > Referred Affiliates Tab. Here, you will be able to see you entire direct downline of referred affiliates in iHub whether they are a part of the ERC program or not.

In the "Affiliate" column it will either be marked as "Active" or blank. "Active" indicates that the user has completed the basic training and is eligible to promote the ERC program. You can also view initial activity such as lead counts, booked call counts, and ERC agreement signed counts.

Our tech team is working on adding more activity columns to help referral partners view further progress of deals being referred by their team.

In this section you’ll find everything you need to promote and market ERC. You have a full toolbox of assets and collateral to educate and refer a business owner to the Employee Retention Credit. We are actively adding more marketing assets and industry specific targeted marketing.

Currently available:

- Landing Pages & Links

- PDF Flyers

- Business Cards

- Email Templates

- Video

- Assets & Graphics

On October 19, 2022, the IRS issued a warning on ERC claims.

They renewed and expanded that warning on March 7, 2023. We at Bottom Line are very pleased that the IRS issued these warnings, as there are many fly-by-night, so-called ERC “experts” or “consultants” that are misrepresenting their experiences and the parameters of the ERC program to employers. Bottom Line is no newcomer, with over 14 years in the cost-savings consulting space. From the very beginning of the CARES Act we have made our clients aware of the ERC opportunity and assisted qualifying clients, many of which are part of the top 100 accounting and law firms and Fortune 1000, in navigating the ERC claims’ submissions process.

Many potential clients will be—and should be—aware of the IRS warnings. The IRS warns employers to carefully review the ERC guidelines before submitting a claim. There are several dubious promoters pushing ineligible employers to file while not informing employers that wage deductions claimed on their tax returns must be reduced by the amount of their ERC refund through amending their returns. The following addresses each of the IRS warnings and how these warnings relate to the services that Bottom Line provides its clients:

Bottom Line provides IRS qualification information to every client. For instance, we highlight that clients may qualify not only based upon a significant decline in gross receipts; they may also qualify if a client’s operations were fully or partially suspended in the event that gross receipts were not impacted.

At Bottom Line, we routinely assist clients with 5 or more W-2 employees navigate the ERC process, including performing calculations to determine the amount that each client qualifies for and assisting in the preparation of IRS filings.

For clients who have already filed their income tax returns for the applicable year receiving ERC, at Bottom Line, we highlight the need for them to amend their returns to correct any overstated wage deductions.

At Bottom Line we are very proud of the services we provide to our clients, which exceed the highest industry standards. We continue to monitor and update our team and clients with respect to any changes to IRS guidance as it relates to the ERC program.

Access ERC Live Webinars & Replays

Tune into weekly ERC Live call. Learn more about how to promote ERC, bring in businesses, hear success stores, questions and answers and compensation training.

Bottom Line Concepts Role in the ERC Referral Program

- Pre-Qualify each Business (client) for ERC. Every single business owner who files their ERC through this program will start off on a dedicated one-on-one call with and expert ERC Advisor. Bottom Line has over 60 full-time in house expert ERC advisors who not only are super friendly, but extremely well trained.

- Collect required documents from the client. Bottom Line will work with the business owner to collect and organize necessary documents to begin preparing the filing. This includes the 941 Forms (Quarterly Federal Payroll), Payroll data per quarter in an excel spreadsheet, and any existing PPP or PPP forgiveness documents. They provide an easy online document upload / questionnaire to help the client send over the docs.

- Prepare the ERC filing and amend necessary documents – With over 40 full-time forensic accounts working around the clock, Bottom Line goes to work analyzing the data provided by the client, and making all the necessary calculations to prepare the ERC filing. They also include the process of amending the 941 forms into the required 941x forms. This is a very complex and intricate process. Luckily Bottom Lines has the expertise and system to get this done as efficiently and accurately as possible.

- Submit the ERC Filing directly to the IRS – Once the ERC filing is ready, the total ERC tax refund amount is calculated and presented to client. Upon the client’s approval the 941x Forms are submitted to the IRS on clients behalf.

- All the steps above can be completed within 2-4 weeks depending on the clients responsiveness and ability to provide necessary documents for the ERC filing.

- The following steps can take anywhere between 4-12 months depending on the size of the business (amount of W2 employees) and the complexity of the filing.

- All the steps above can be completed within 2-4 weeks depending on the clients responsiveness and ability to provide necessary documents for the ERC filing.

- Approval from the IRS – Both Bottom Line and the client get a notification from the IRS that the ERC claim has been approved, and for how much.

- Receive Payment from the Client – Client receives their check, and Bottom Line invoices the client to collects their contingency fee.

- Pay iHub Inc – Once Bottom Line has recovered funds directly from the client based on the contingency fee, a portion of that is paid to iHub Inc on the 15th of each month. These funds are used to be distributed to referral partners for each of their individual efforts based on the ERC Compensation Plan.

A Proven ERC Track Record for Businesses

Bottom Line Concepts a proven track record in assisting companies recover taxes and wages they have already paid on their W2 employees with zero upfront cost to the business. Their experienced, knowledgeable, and dedicated team will handle the entire process from beginning to end with the IRS on behalf of the business, and work closely with them to collect necessary documents and recover the most possible funds as quickly as possible.

The Entire ERC Process Handled from Beginning to End

The team over at Bottom Line are truly experts in what they do – and they specialize in complex government tax and refund related filings precisely like the Employee Retention Credit. They have completed over 16,000 ERC filings, and recovered over $3 billion dollars in ERC tax credits. That’s no chump change. It takes a serious operation to be able to deliver on that, and they have proved themselves every step of the way.

Bottom Line Concepts has History and Rapport

Bottom Line Concepts is a division of Bottom Line Savings. Founded in 2009, Bottom Line Savings is a no risk, contingency-based cost savings company. They negotiate on behalf of their clients to get the best prices possible from their existing vendors. They audit old invoices for errors getting our clients refunds and credits, and they increase the profitability and overall valuation of their client’s organizations.

Bottom Line Savings primary client base was fortune 500 and fortune 1000 companies who produced over $100,000,000+ per year in revenue / sales. They focused their services on Government aid, unrealized funds, and specific cost-savings analysis.

Companies that Trust Bottom Line Concepts

Bottom Line Concepts clients include names like Starbucks, Visa Uber, McDonald’s, Rolex, the New York Yankees, the LA Lakers, Chase Bank, MetLife, Comcast GNC, Burger King, Versace… The list goes on.

iHub Global's Role in the ERC Referral Program

Most importantly, iHub Global has created a strategic partnership agreement directly with Bottom Line Concepts. This allows iHub to provide it's members with a unique and robust referral program. With a custom-tailored and tech driven approach this ERC referral program is found to be superior that anything else out there. Here are some of the rolls that iHub delivers in this program:

- Systems and Processes – With any referral or affiliate program, having a solid foundation of systems and processes are vital. iHub Global has vast experience in planning, developing and deploying complex referral based opportunities to the masses. With the ERC Affiliate program, iHub Global has delivered an streamlined approach for people to join, get started, and have access to all the tools they need to refer a business to the Employee Retention Credit, or even bring in a new ERC Referral Partner.

- Platform and Technology – At it’s core, iHub Global is really a tech company. They maintain a full-time team of highly skilled software developers, engineers, database architects, and server administrators. Using their proprietary platforms, iHub Global deploys each referral opportunity including this ERC referral program with a powerful easy-to-use web portal and affiliate back office.

- Training and Education – Education is key, and when it comes to the masses, sometimes it can feel like herding sheep. Luckily, iHub Global provides educational resources and training that the average person can understand. This includes, video training, frequently asked questions, presentation, e-courses, and daily live webinars to ensure that there is clarity and confidence when bringing any product or service to market.

- Marketing and Automation – iHub Global delivers just about every marketing asset you can think of. When promoting any opportunity or affiliate program – having strong congruent, and compliant marketing material is crucial. From email templates, print assets to digital landing pages and email automation. iHub Global takes no half measures when it comes to the success of their affiliates and helping them to hit the ground running.

- Initial Client Onboarding – Every prospect (potential ERC business client) starts their journey via iHub systems, links, opt-in forms, landing pages, or otherwise ways to capture and onboard the initial lead as an ERC business. The first step usually us to use an existing digital market asset they provide all of their referral partners with, to educate, build trust, and bring the client into the network. From there, the next step would be to schedule a call with an Expert ERC advisor at Bottom Line Concepts. Once the business moves on from iHub “eco-system”, the rest is taken care of by bottom line. This is what makes the process so easy for ERC Referral partners. Their only job is to make that introduction, and get them into the system to book their call – Easy!

- Tracking and Visibility – This is one of the most important factors when promoting any product or service – especially this ERC referral program. Full transparency and visibility of every client, every step of the way. This is exactly what iHub Global has delivered to ERC Affiliates using their platform. Their robust dashboard

- Compensation Plan and Payouts – Once funds are received from Bottom Line Concepts, iHub Inc will reconcile funds owed to each individual referral partner, and convert them into eligible commissions based on the ERC Compensation Plan. Eligible commissions will be paid out on the next available payout distribution date.